Taskforce on Nature-related Financial Disclosures: A series looking at the global sustainability reporting landscape and the various frameworks

Jun-06-2023

This is the first in a series looking at the global sustainability reporting landscape and the various frameworks, standard setting bodies, industry bodies and jurisdictional requirements we need to be aware of as we navigate the Net-Zero journey. This series is developed by our Head of Product, Geoff Horrell, and Dougall Hamilton, Business Analyst.

What is the Taskforce on Nature-related Financial Disclosures?

The Taskforce on Nature-related Financial Disclosures (TNFD) was established in 2021 to address the pressing need for incorporating nature into financial and business decisions. Recognising that society and businesses rely on the essential services provided by nature, escalating global nature loss poses significant risks to both businesses and providers of financial capital.

However, there are also opportunities for businesses and financial institutions to effectively manage these risks, engage sustainably with nature, and generate positive outcomes for the environment, their organisations and society.

The critical state of our planet's ecosystems has reached a pivotal juncture, and carries substantial risks for societies and businesses alike. Governments worldwide are increasingly recognising the importance of halting and reversing nature loss, as demonstrated by more than 190 states committing to ambitious goals and targets under the Global Biodiversity Framework (GBF) in December 2022. Biodiversity loss is now recognised by central banks as a systemic risk alongside climate change.

The TNFD is a global, market-led initiative with a mission to develop and implement a risk management and disclosure framework. This framework will enable organisations to report on and address evolving nature-related risks and opportunities. The ultimate goal is to facilitate a shift in global financial flows away from nature-negative outcomes and towards nature-positive outcomes.

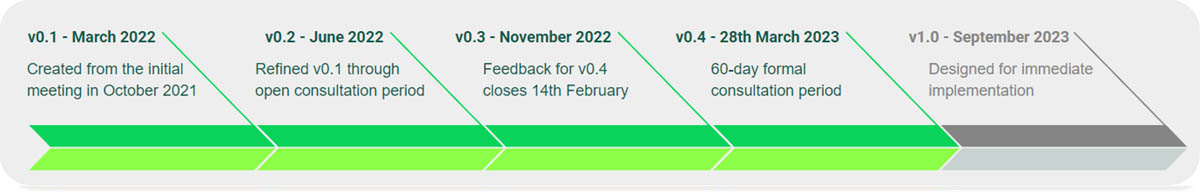

After two years of framework design and development, the Taskforce is nearing the completion of its first integrated risk management and disclosure framework for nature-related issues (v1.0). The framework is set to be released in September 2023 and will be ready for market adoption.

How Is Downforce Involved with The TNFD?

Downforce Technologies is a member of the TNFD Forum - a group of more than 1,000 companies, financial institutions, government ministries, regulators and civil-society organisations.

We are also a member of the Data Catalyst program and participated in a series of workshops in February 2023 facilitated by PWC and attended by more than 100 representatives from organisations specialising in sustainability data, analytics and workflow tools.

Downforce Technologies is in the process of piloting the TNFD framework in collaboration with a number of different companies (Banks, Food Processors, Food Retailers and Sustainability Consultants). Initially our work will focus on specific supply chains (Cotton, Beef and Dairy production in Australia and Soybean production in Brazil)

Who is TNFD Designed For?

· The TNFD Framework is designed for corporates and financial institutions, with additional guidance provided for specific sectors including agriculture, food and forest products. The TNFD will continue to develop further guidance on how to implement the LEAP approach (Locate, Evaluate, Assess and Prepare) and disclosure recommendations across a diverse range of users and sectors. For example, the fashion and consumer goods sector is now represented at the Forum level

· The TNFD is acutely aware of the complex nature of the global reporting landscape and the various frameworks, standards setting bodies, industry bodies and jurisdictional requirements that companies face. The desire is to connect these initiatives and provide a global framework for companies to disclose their nature-related impacts and dependencies, risks and opportunities. The TNFD Framework references many of the existing initiatives throughout Annex 4.3 Disclosure Metrics - including but not limited to:

- SBTi

- SBTN

- GHG protocol

- ISSB

- GBF - the TNFD specifically addresses Target 15 of the GBF

- GRI

- ESRS (European Sustainability Reporting Standards)

The Downforce Perspective on the Adoption Rate of the TNFD Framework

We believe that the following factors will contribute to the adoption of TNFD :

TCFD Reporting: Companies that are already reporting against the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) will likely have established reporting processes that include target setting, risk assessment and supply chain measurement. These companies can leverage their existing reporting mechanisms to incorporate TNFD reporting. It is expected that clients who are familiar with and have implemented TCFD recommendations will be early adopters of TNFD, even before it becomes mandated or recommended in their respective countries.

SBTi Flag Companies: Companies mandated to report under the Science Based Targets initiative (SBTi) Flag will be another significant group that is likely to adopt TNFD early on. This includes companies in sectors such as food, fashion, land management and agriculture that have set science-based emission reduction targets. These companies are closely linked to the impacts of land use change and their emission reduction plans involve nature-based solutions. Hence, they will be among the first to adopt TNFD due to their direct exposure, ability and existing binding commitments under SBTi.

ISSB and Financial Reporting: The International Sustainability Standards Board (ISSB), responsible for developing official sustainability reporting guidelines under the International Finance Reporting Standards (IFRS), is currently working on integrating sustainability guidelines into financial reporting. This marks the first time that official sustainability reporting guidelines will be implemented alongside financial reporting. The ISSB has stated its intention to adopt both TCFD and TNFD frameworks for reporting. As the ISSB covers financial reporting for most companies in most countries worldwide, its adoption of TCFD and TNFD will significantly accelerate the widespread adoption of TNFD globally.

Jurisdictional Mandates: While some voluntary adoption of TNFD will occur, we anticipate that broader adoption will require country-by-country mandates. However, once the International Financial Reporting Standards (IFRS) officially adopt TNFD, its implementation will likely be accelerated globally, as IAS/IFRS is already widely adopted as the financial reporting standard.

Back To News